The brand new Pursue Buyers 300 Pursue Overall Bank account Give

Pursue is a far greater selection for a bank checking account that have a great low minimum starting put. Chase examining accounts lack the absolute minimum opening put, when you’re Lender from The united states checking accounts range from 25 to one hundred. Pursue Safer Banking℠ doesn’t fees overdraft fees; it refuses deals who would lead to an awful examining balance. Chase Sapphire℠ Financial and you can Chase Individual Customer Examining℠ waive the initial 4 overdrafts in the newest and previous 12 report episodes. The brand new Pursue Senior high school Checking℠ account is a teenager checking account meant for college students years 13 to 17. People could only have this account until it change 19; then, it could be instantly converted into a good Pursue Total Examining account.

TD Lender Past Checking – 3 hundred

- Luckily, there are many financial promotions out there which do not need lead put.

- But wear’t get immediately drawn in the from the hope away from prompt dollars.

- While we action to the January 2025, of several financial institutions are gearing around offer tempting bank account bonuses to draw new clients.

I’ve done this and possess fifteen chase membership, biz and personal. One of the great things about banking which have Pursue is you gain access to a powerful department and you may Atm exposure. We along with usually do not fees an overdraft fee for sure something, such as if a deal is actually declined or came back unpaid, and purchases that will be 5 or shorter. You could attempt to choose because of him or her and take advantage of as much as you can, of course.

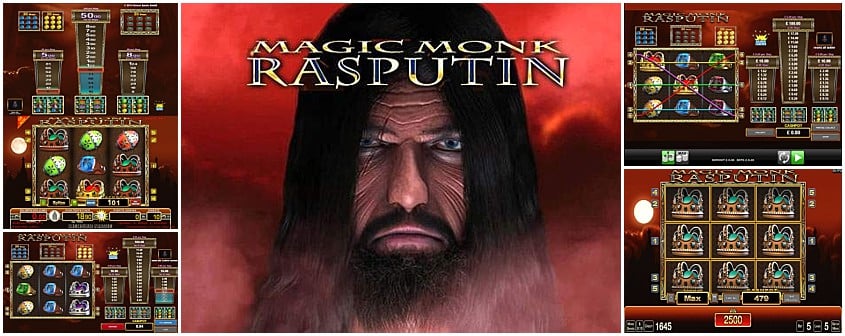

It’s better to pick a merchant account which have lowest fees, and bonuses such rewards and large rates of interest. PNC https://happy-gambler.com/dazzle-me/rtp/ doesn’t require that you look after at least put regarding the account for a certain time period. One to truth as well as the large energetic APYs can make these incentives well worth searching for. When you’re Huntington’s checking bonuses try stable and you can glamorous also provides, they’re also limited in order to people staying in 10 claims.

Chase Biggest Along with Checking

Most delight in you explaining the decision about any of it and you will it is possible to risk issues. What do your determine as the “limited mastercard choices” which could twist a danger when the much more sight are on your membership? I imagined regarding the company banking added bonus and you will guess the suggestions can be applied truth be told there as well. Could keep your bank account safe having features for example No Liability Shelter, scam keeping track of and you may cards lock.

You might mix Chase SavingsSM with Pursue Prominent In addition to CheckingSM to make much more. One which just manage, but not, factors to consider you’re also capable see all requirements meanwhile. Thankfully, an identical Pursue banking incentives I can take advantage of try now available to everyone. A huge Pursue bonus will always need you to open a good Chase Complete Checking and Chase Savings℠ membership meanwhile. And you need match the criteria away from each other account to find the benefit.

Such, for many who buy automobile insurance monthly, you could potentially spend 90 days otherwise 6 months in the future. You might also score a savings to have performing this, along with the debts taking your closer to hitting the needed paying to suit your greeting incentive. Just make sure you could potentially pay back the balance so you don’t get hit with pricey interest charge. TD Bank offers perks for brand new consumers which unlock the TD Over Checking and you can TD Beyond Checking membership.

I eliminated also provides that had a lot of time carrying episodes or standards one to spanned more than numerous report cycles. For individuals who’re eager to discover banks with quick signal-upwards bonuses, you’lso are from the best source for information. On the other side prevent of your own range, the customer service member verified the new airline slow down and i also soon received various other text inviting me to rebook my personal trip on the overnight. A few hours later on, precipitation become raining — just like the trip had predict.

Banking institutions explore indication-up incentives to distinguish on their own of anybody else in the industry. Dollars incentives as well as assist financial institutions bring in new customers and the fresh places. You can’t combine it incentive along with other Wells Fargo account incentives. When you yourself have acquired a good Chase examining bonus in the last a couple of years, you’re not entitled to it render. Pursue is not guilty of (and you can cannot render) one points, characteristics otherwise content at that 3rd-people site or software, except for products and services you to definitely clearly hold the newest Chase identity. Pursue Biggest In addition to Checking℠ won’t costs Atm costs at the non-Pursue ATMs for as much as 4 times for each statement several months.

Discover how to earn hundreds of dollars by simply starting an excellent checking or checking account if you are enjoying the several benefits from banking having Pursue. For those who wear’t be considered from a bank account promotion, your won’t earn the main benefit. However, you might usually keep using the brand new membership and just about every other perks you’re eligible to have. Finding a bank bonus means staying the fresh membership within the a position.

Essentially, bank account having high bucks incentives are certain to get harder incentive conditions to fulfill. Such as, you might have to put 25,100000 or even more on the membership within the first 90 days and maintain you to definitely equilibrium number for a few days. For every lender have a tendency to number the needs you should satisfy by a designated schedule.

Neither Chase nor Wells Fargo also offers examining account instead monthly financial repair charges. The brand new month-to-month features for the examining accounts from the both banks try equivalent, and you may need meet the requirements every month to your percentage to be waived. You continue to you are going to imagine certainly their higher-tier checking profile for those who continuously manage a high account balance or meet among the other standards to possess waiving monthly services charges. One of the better Chase incentives currently available may be worth upwards to 900 for many who open one another a Chase Full Family savings and you may a Chase Checking account and you may see particular terms. If you unlock another Pursue Total Bank account and place upwards a direct deposit (of any number) inside ninety days, you’ll secure a great 300 incentive.